In the world of risk advising, we all know the grind. There’s a lot of manual effort that goes into understanding and engaging with clients. It’s time-consuming, and frankly, it can be a bit of a slog. Now, imagine a tool that helps you get closer to your clients without the heavy lifting – that’s where surveys come in. They’re a fantastic way to bring efficiency into the client engagement process. They’re affordable, easy to use, and they really make a difference. Here’s why:

- More Insight, Less Effort: Get to know your clients better without breaking a sweat.

- Low-Cost Engagement: Engage with your clients digitally without burning a hole in your pocket.

- Efficient Annual Reviews: Make those often-missed yearly check-ins with risk clients a breeze.

In this guide, we’ll walk you through how surveys can help you with all of this and more. Let’s get into it.

Surveys: More than a Feedback Mechanism

- Assess Client Satisfaction through NPS: The Net Promoter Score (NPS) can be an excellent metric for understanding client loyalty, especially after initial onboarding.

- Facilitate Referrals: Digital surveys streamline the process of obtaining client referrals, making it engaging and straightforward.

- Automate Annual Reviews: Advisers can efficiently identify client needs and changes, especially in risk advising where yearly reviews may be challenging to conduct manually.

A little more on NPS

NPS is a standout metric in client surveys. It’s a simple question: “On a scale of 0-10, how likely are you to recommend our service?” The responses are then divided into three categories:

- Promoters (9-10)

- Passives (7-8)

- Detractors (0-6)

The Net Promoter Score is calculated by subtracting the percentage of Detractors from the percentage of Promoters. The NPS is a powerful way to gauge client satisfaction, especially after key touch points like an initial client onboarding or a review meeting. It’s not just about the numbers; the comments and qualitative feedback can provide valuable insights into enhancing the offering.

The numbers matter of course – but much of the real value comes from the comments you’ll receive in the follow-up question “Why did you give this number”.

This is what will provide you the best insights on whats working well – and what you might think to work on!

How Surveys Apply to Advisers

- Understanding Client Needs: Tailored services become possible with the insights gathered from well-crafted surveys.

- Engaging in a Digital World: Surveys offer a contemporary and interactive way to connect with clients.

Survey Tools to Consider

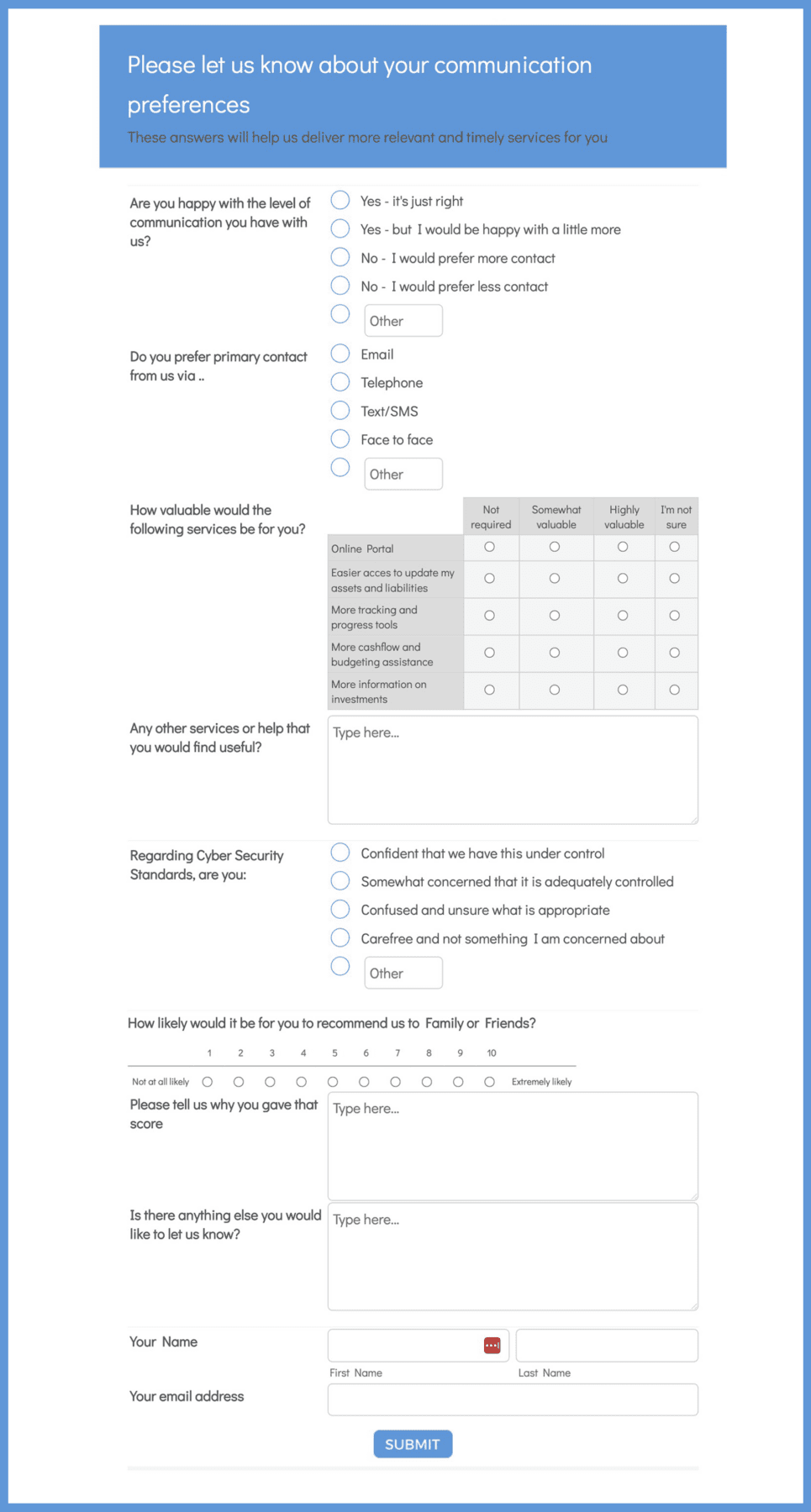

Platforms like Jotform, Typeform, or SurveyMonkey offer varying degrees of automation and integration. Choosing the right one depends on your specific needs and existing workflow.

Practical Implementation

- When to Use Surveys: After key milestones or initial onboarding.

- Emphasise Comments and Feedback: Encourage qualitative insights to further refine your approach.

Client Review Process: A Closer Look

The review process can be cumbersome, particularly in risk advising. Surveys can transform this:

- Automated Insights: Cut down on manual effort by automating the collection of relevant client information.

- Regular Reviews Made Easy: For risk clients, surveys enable more frequent reviews, ensuring alignment with their changing needs.

- A Modern Touch: Transform the review process from a tedious task to a dynamic and engaging experience, thereby enhancing your service offering.

Wrapping It Up

Surveys are an untapped resource for advisers, especially in risk. By integrating them into your practice, you gain a more profound understanding of your clients, collect valuable referrals, and enhance the efficiency of your review process.

Ready to start? Explore our Sample Template for Client Referrals in the Resources section, and stay ahead by embracing surveys in your advising practice.

We are establishing a dynamic resource centre that will continuously evolve as we enhance our collection of resources.