The $15 Million Wake-Up Call: Why Your Online Invisibility is Costing You

Picture this: You’ve built decades of trust, delivered exceptional results, and nurtured relationships that span generations. Then, in a single conversation, you lose a $15 million client because their adult children couldn’t find a trace of you online.

Sound far-fetched? Ask any adviser who’s experienced this exact scenario – it’s happening more frequently than you’d think.

Angus Woods from Adviser Ratings recently shared this sobering reality, and it’s one that should make every adviser pause. Benjamin Marshan’s research reveals an interesting paradox: while 94% of advised clients trust their adviser completely, only 10.4% of Australians actually receive professional advice. Most people trust advisers, but most people don’t have one. As more Australians look for advice, your online presence clearly matters.

The brutal truth? If you’re not online, you don’t exist to the next generation of wealth.

The Good News: You Don’t Need a Marketing Degree (Or Budget)

Before you start worrying about needing to become the next TikTok sensation, take a breath. Building credible online presence isn’t about viral videos or hefty marketing budgets – it’s about being findable and trustworthy when it matters.

Most of the tools you need? They’re sitting there, free, waiting for you to claim them. LinkedIn, Google Business, Adviser Ratings – these platforms cost nothing but a bit of time and attention.

Your Online Presence Checklist: The Non-Negotiables

1. Your Website: Y our Digital Shopfront

our Digital Shopfront

Think of your website as your office reception – except it operates 24/7 to make great first impressions, rain or shine.

The essentials that actually matter:

- What you do (skip the industry jargon – clear, simple language wins every time)

- Who you help (be specific – “successful professionals” beats “everyone”)

- Your story (here’s something most people don’t realise – the About page is often the most visited page on adviser websites. People want to know who you are, your background, your team. They’re not just buying your services; they’re buying into you as a person. Include staff profiles, your journey into advice, what drives you. Make it human, make it real)

- How to reach you (simple contact form, not a digital maze)

This isn’t just about lead generation – it’s about making it easy for existing clients to refer you, for their adult children to research you, and for your business to be properly represented online.

Don’t overcomplicate it. A clean, professional site that loads quickly and tells your story clearly will outperform a fancy one that confuses visitors every time.

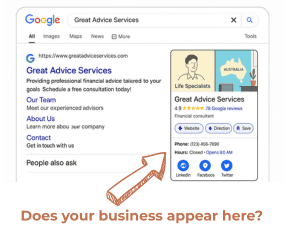

2. Google Business: Your Local Lighthouse

Let’s be honest – Google isn’t always the simplest or easiest platform to deal with. Their verification processes can be frustrating, and sometimes their systems seem to have a mind of their own. But here’s the thing: it’s worth the effort. This free listing is where potential clients often land first when searching for financial advisers in your area. It’s your chance to control the narrative before they even visit your website. Location, contact details, reviews, and professional photos that actually represent your business well all matter here. When someone searches for you or your practice, this is often what they see first. Yes, claiming and optimising your profile might require a bit of patience with Google’s processes, but the visibility payoff makes it worthwhile.

3. LinkedIn: Your Professional Magnet

Before worrying about posting content, focus on the fundamentals. Start with a recent, professional profile photo – not a cropped holiday snap from 2015. Complete your About section with clear, conversational language about what you do and who you help.

But here’s the crucial step most advisers miss: claim your

LinkedIn business page. This isn’t just another profile – it’s how your practice appears as a legitimate business entity. Link yourself and yourteam members to this business page so when people research your firm, they see a cohesive, professional organisation rather than scattered individual profiles.

This foundation makes you searchable and credible when clients or their networks are doing their research.

4. Adviser Ratings: Your SEO Secret Weapon

Here’s what many advisers don’t realise: Adviser Ratings consistently ranks highly in Google search

The good news? Getting the basics right isn’t complicated. Claim your profile, ensure your contact details are current, add a professional photo, and complete your qualifications and services sections. The platform does much of the heavy lifting for you.

But the real power lies in client testimonials. Those reviews aren’t just nice-to-haves – they’re trust signals that cut through the noise of an increasingly crowded market. When referred clients research you (and they will), this is often their first stop. A well-maintained profile with genuine client feedback can be the difference between a prospect picking up the phone or moving on to the next adviser.

The investment of time is minimal, but the visibility payoff is significant – especially considering it’s essentially free advertising that ranks well in search engines.

5. The Consistency Factor

Your branding, contact details, and messaging should tell the same story everywhere. Inconsistency breeds doubt, and doubt kills conversions. When someone gets referred to you, they shouldn’t have to guess if they’ve found the right person.

Case Study: From Digital Ghost to Properly Represented

We recently worked with a practice that was practically invisible online. New licensee, old digital baggage, no website, unclaimed profiles – the works.

The transformation:

- Professional website launch

- Claimed and optimised all business profiles

- Cleaned up historical digital debris

The results within months:

- 100+ monthly website visitors

- Several hundred Google Business views

- 200+ direction requests to their office

- Multiple enquiries from both new prospects and referral sources

The investment? Minimal compared to traditional advertising. The real benefit? Their business was finally represented properly online, making it easy for clients to refer them and for those referrals to find and research them confidently.

The Reality Check

Your next ideal client is researching you right now. What are they finding?

If the answer makes you uncomfortable, you’re not alone. Most advisers built their practices through referrals and relationships – digital presence wasn’t part of the playbook. But times have changed, and so have client expectations.

This isn’t about abandoning what’s worked – it’s about ensuring your excellent work and reputation are properly reflected online. When a client wants to refer their colleague, or when that colleague’s adult children want to research you, what story does your online presence tell?

The choice is simple: Adapt to how clients research and choose advisers today, or watch younger demographics pass you by for competitors who understand the new rules.

Ready to Take Action?

Building your online presence doesn’t have to be overwhelming. Start with one platform, get it right, then expand. Focus on accuracy, consistency, and professionalism rather than perfection.

Remember, this isn’t just about attracting new clients – it’s about making it easier for existing clients to refer you, ensuring those referrals can find and research you properly, and presenting your business as the professional operation it truly is.

Curious about your current online presence? We help advisers audit and enhance their digital footprint – because your expertise deserves to be properly represented when clients and referrals are looking. Get in touch if you’d like some help getting your online brand sorted.

For more insights from industry leaders, check out Angus Woods’ LinkedIn post on the importance of online reviews.