CDM Solutions

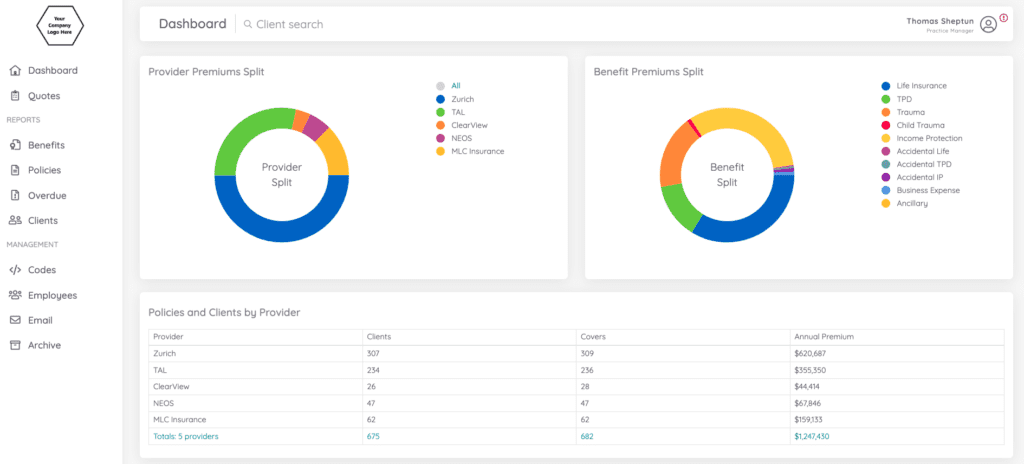

Save time with the only stand-alone client insurance reporting system on the market.

Description

Melbourne-based CDM Solutions has been operating on a commercial basis for advice practices since August 2022 following an extensive pilot phase over the last eight years during which all elements associated with life insurance policy data downloads and ongoing policy management functionality were thoroughly stress tested.

Adviser and entrepreneur, Katriel Warlow-Shill started out as a project to improve the efficiency of his own practice and its profitability.

Following the extended pilot phase, Warlow-Shill says CDM Solutions now offers a service that is unique in the Australian market, which:

Automatically downloads and updates all life insurance policy data from every active retail insurer three times per week.

Provides up-to-date information directly from insurance providers of any overdue policy premiums.

Offers an instant production of a completely customised policy schedule saving staff, according to CDM Solutions, between five to 30 minutes of their time per policy renewal.

Has the capacity to fully automate multiple client email notifications such as policy renewals with attached policy schedules, birthday congratulations, overdue premium issues etc.

Offers quotation facilities through a partnership with research firm Omnium which will now provide instant quotations for new business as well as for updated quotations on all in-force policies

As of June 2023, 210 practices with over 100000 clients use CDM to manage their in-force insurance book.

For more information or to sign up for CDM's platform, visit their website at https://cdmsolutions.com.au.

** Head here to check out the session recording from the Risk Support Showcase in November 2024!